Hi friends,

Welcome to The ₿it Economy! I’m Rob, and each week I write a blurb about something I learned that’s broadly Bitcoin related. If you have thoughts, I'd love to hear from you. My goal is to shed a tidbit of info that I believe will get you thinking about the digital world around you. If you know anyone who would be interested, please do forward this along, send them to the archive, or have them subscribe here. 👇

-Rob

This week the world's central bankers gathered (virtually of course), in Jackson Hole for the annual Economic Policy Symposium. There, Fed Chair Jerome Powell discussed inflation (aka the general increase in prices and fall in the purchasing power of money) and how the United States' central bank plans to target an average rate of 2%.Therefore the Fed will be more than comfortable with inflation climbing above 2%, a prospect that at one point would be considered blasphemy.

The Fed no longer thinks there's a tradeoff between low levels of unemployment and inflation. There is now a new emphasis on job growth much more than the risk of rising prices. With this decision, Powell reverses former Chairman Paul Volcker's move to lower inflation some 40 years ago. For those of you who were not yet born (or simply don't remember), during his time under the helm, Volcker led the country into a recession after series of interest rate hikes aimed at lowering inflation. To his credit, the U.S. made it through to the other side. However, the lasting effects have left us with a shell of an economy built on stilts.

The inflation we have seen has been manufactured. It is a combination of fiscal and monetary policy measures that are not benefiting everyone in our society. As a result of low interest rate policies and money printing, we have seen dramatic increases in asset prices. This overwhelmingly benefits the wealthy that own assets (ie Cantillon Effect) creating ever-increasing amounts of wealth concentration. So much concentration that we have not seen higher levels since the 1920s.

Unfortunately, what many fail to see is the reality of technology driven deflation. It is a frightening term for central banks, but we should embrace it. A drop in prices enables the purchasing power of every individual to increase. Leaving Americans less to worry about maintaining one's standard of living like food, housing and energy become cheaper and more available.

However, it is more likely that Governments and central banks will continue to do what they've always done, albeit at an accelerated pace because we've hit the law of diminishing returns.

“Quite plausibly, to keep driving growth against an exponentially increasing technology deflation, global debt could become a number so high that the only way out is to hit the reset button. The truth is we have probably already passed that point at which a complete reset is required.” — Jeff Booth, Author The Price of Tomorrow

And since we're targeting a higher inflation rate, it is important to be aware of potential asset hedges. One of the most common hedges against inflation is gold, due to its limited supply and scarcity. Therefore during times of economic crises, most people pull their wealth out of fiat currencies and into precious metals, to preserve their value. Bitcoin shares many of the same properties of gold, most notably that it is a scarce and limited source. By now we should all be aware that there can only ever be 21 million Bitcoin in existence and not a single one can be created arbitrarily.

But if a recession does ensue, it's important to focus on how store-of-value assets like Gold and bitcoin react thereafter, not during. It's also imperative to keep in mind that gold was not really a "safe haven" during the 2008 financial crisis. Like the S&P500, the gold market saw a ~30% crash in the second half of 2008. Only a year later did the precious metal rebound and begin to climb up to levels near $1200.

So what does this mean for bitcoin? Well for one, it solves monetary inflation by removing policy control from individuals and replacing it with rigid software and outstanding network effects. And in its still young life, it's three halving events, occurring roughly every four years, have been suspected to be major catalysts behind Bitcoin's major bull markets. Bitcoin’s mining reward halved from 50 BTC to 25 BTC in 2012, and in 2013 the price exploded by two orders of magnitude from about $13 to about $1150 in December of that year. In 2016 it halved from 25 BTC to 12.5 BTC and in 2017 Bitcoin’s price exploded 20x from $1000 on January 1st to roughly $20,000 by mid-December.

The world is well into the age of inflation — the 50-year experiment in radical fiscal and monetary policies that have guaranteed rising prices and led to an exacerbation in inequality and indebtedness. Assets like Bitcoin offers an insurance policy against monetary and fiscal policy irresponsibility. Perhaps check it out or be left waiting for Papa Powell to explain to you and millions of other Americans with no assets or stocks that raising the inflation target above 2% is a good thing.

Threads🧵

Breakdown of long-form content into an easy to read and concise format.

News 📰

The top announcements in Bitcoin. All in one place.

Matt D'Souza, Founder & CEO of Blockware Solutions and Blockware Mining passed away

Fidelity President Files for New Bitcoin Fund

Trezor Partners with Unchained Capital for Multisignature Vaults

Boltz deploys Channel Creation Swaps

Equinor partners with Crusoe Energy Solutions

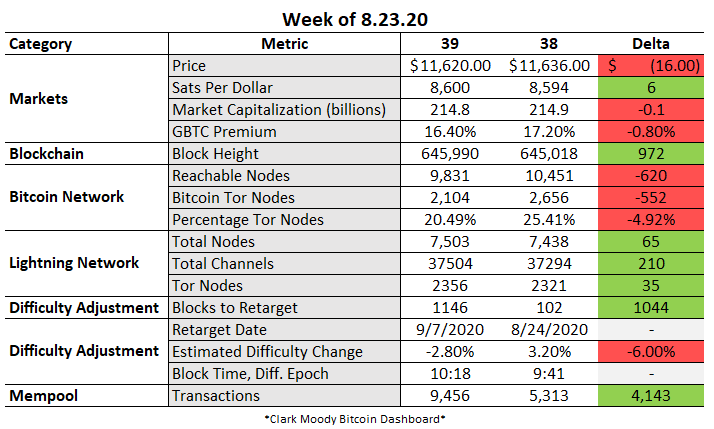

Market Watch 💸

One-stop-shop Bitcoin market & network snapshot.

What I'm Reading 📕

Scowered the internet so you didn’t have to.

Ethereum's Fees Mean Choosing Between a World Computer and a Financial Network

Fed Actions are Unlikely to Boost Bitcoin in the Near-Term

Going Public Circa 2020; Door #3: The SPAC

Bitcoin Optech Newsletter #112

What I'm Listening To 🔊

Give your eyes a break and pop in the earbuds.

FATF, Bitcoin, and the International Order

The Banking Sector and the Future of Dollar Dominance

Why Bitcoin is the Most Advanced Form of Money

Mastermind with Lyn Alden, Luke Gromen & Jeff Booth

Rolling Funds and Their Impact on The Future of Venture

Tales from the Crypt #138: Chris Bendiksen

What I'm Watching 📺

Take a break from Netflix and check these out.

Setting up Bitcoin node Umbrel in 2 minutes

Cred's Technical Analysis Lessons

Housekeeping 🏡

Who doesn’t like free money and information?

📅 Subscribe here to stay up to date on early-stage companies building on Bitcoin

🏗️ Aggregated videos, podcasts, news & more from the top Bitcoin startups

🦢Sign up for Swan Bitcoin and receive $10 with your first purchase

Final Quote 🎩

Thanks for reading. Send me tips, stories I’ve missed, or comment below. And if you liked this piece, you can sign up here for more issues of the Bit Economy, a newsletter on something bitcoin related.

Until then, have a great week! See you next Sunday.