Week of 2.23.20 - Issue #16

Welcome to the 16th edition of the ₿it Economy! Each week, I break down the top stories in Bitcoin in a simple in clear format. Enjoy!

Topics: A Bank for Bitcoin & Bitstamp Adopts Bech32

The Brief:

The Brief: U.S. stocks fell sharply throughout the week, Treasury yields slid to a record low, gold prices are in decline, and Bitcoin followed suit. But it is not all bad news for Wyoming. Nicknamed the "Equality State", officials are putting their motto where their mouths are. On Monday, a Wyoming corporation applied for a special purpose depository institution (SPDI) charter with the state's division of banking to offer regulated services for digital assets. As for the other side of the world, Luxembourg based Bitstamp, holders of the industry's oldest active exchange announced compatibility for SegWit Bech32 addresses. For those who are more technically inclined, checkout the newly formed Chaincode Podcast links at the bottom where John Newberry sits down with developers to discuss bitcoin protocol development. The first two feature Pieter Wuille, who has made several appearances in the short existence of this newsletter.

S1: Avanti Applies for Wyoming Bank Charter

What is it? - Caitlin Long, the former Wall Street veteran more recently known for her blockchain legislative work in the state of Wyoming announced that she will be starting Avanti Financial Group Inc., a corporation formed to apply for a bank charter under Wyoming's special-purpose depository institution (SPDI) law. The law approved in February of 2019 was introduced to serve those businesses unable to secure FDIC-insured banking services due to their dealings with cryptocurrency. The charter would permit Avanti to offer a range of services such as payment, custody, securities and commodities for institutional customers that interact with digital assets.

“A crucial step in the digital asset industry’s evolution is the formation of a new bank dedicated to bridging digital assets with the US dollar payments system in a compliant manner, and the provision of custodial services that meet the strictest institutional standards.” - Caitlin Long

The bank recently raised an undisclosed seed round and has partnered with notable Bitcoin infrastructure firm Blockstream to offer Bitcoin applications, software and hardware. The firm is going through the charter application process and expects to open in early 2021.

Why it Matters? -The hard work performed by the Wyoming Blockchain Task Force had led to a new effort to allow crypto-related startups in the United States to enjoy the same level of banking infrastructure made available to their international counterparts. This "backdoor" to the infamous New York BitLicense allows firms to fall into the same category as state-chartered banks and thereby be able to offer service to customers across 42 states U.S. States without obtaining an additional state license. Prior to this announcement, the American digital asset ecosystem was missing a critical piece of banking infrastructure that primarily kept major financial institutions (e.g., pensions or sovereign wealth funds) on the sideline. If all goes according to plan, these large monetary players have a regulated banking partner to deliver services around Bitcoin. For more information check out her recent talk about Avanti here.

Final Take - Money will flow to the forward thinking financial States.

S2: Bitstamp Supports SegWit

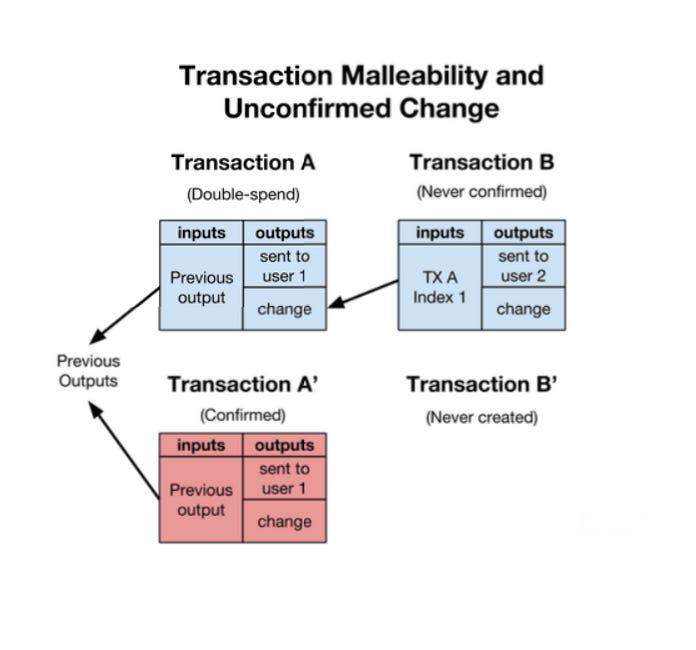

What is it? - On Thursday, Bitstamp, a European based cryptocurrency marketplace has announced that it now supports SegWit bech32 Bitcoin addresses. Segregated Witness, commonly referred to as SegWit, is an implementation first introduced by Pieter Wuille in 2015 to assist Bitcoin in scaling and to fix transaction malleability. Transaction malleability is an attack that lets someone change the unique ID of a bitcoin transaction before it is confirmed on the bitcoin network. Thus, a malicious actor can pretend that a transaction did not happen.

Transactions consist of two main components - inputs and outputs. Essentially, an input contains a public address of the sender, while the output contains the public address recipient. However, the sender must prove that they have the funds being transferred, and they do so with a digital signature. In order to stop witness data from being used to change transaction IDs, Wuille suggested removing the data from the transaction altogether. A segregated witness creates a sidechain where the witness data is stored away from the main blockchain. Therefore, transactions IDs are no longer under threat from nefarious actors. This reorganization of block data allows for more transactions to be stored in a single block, and thus increases the transaction throughput of the network.

As all of you should know by now, Bitcoin transactions are written on an immutable ledger known as a blockchain. These blocks of transactions are limited in capacity up to 1MB. As a result, a Bitcoin block is able to accommodate around 2700 transactions on average. Without SegWit, the signature data can take up to 65% of the block. On the other hand, with SegWit, the block size effectively has a block weight of 4MB. A block's weight is a combination of the previously mentioned 1MB of information stored on the main blockchain as well as the witness data stored on the sidechain. This inherently allows the network to process more transactions without changing the overall Bitcoin blockchain size.

Now for Bech32, the address format was created in BIP173 specifically for SegWit. It allows the direct use of the implementation without the "wrapper". One of the main differences of Bech32 format is that it is not case sensitive, which in turn leads to less confusion when writing down the address.

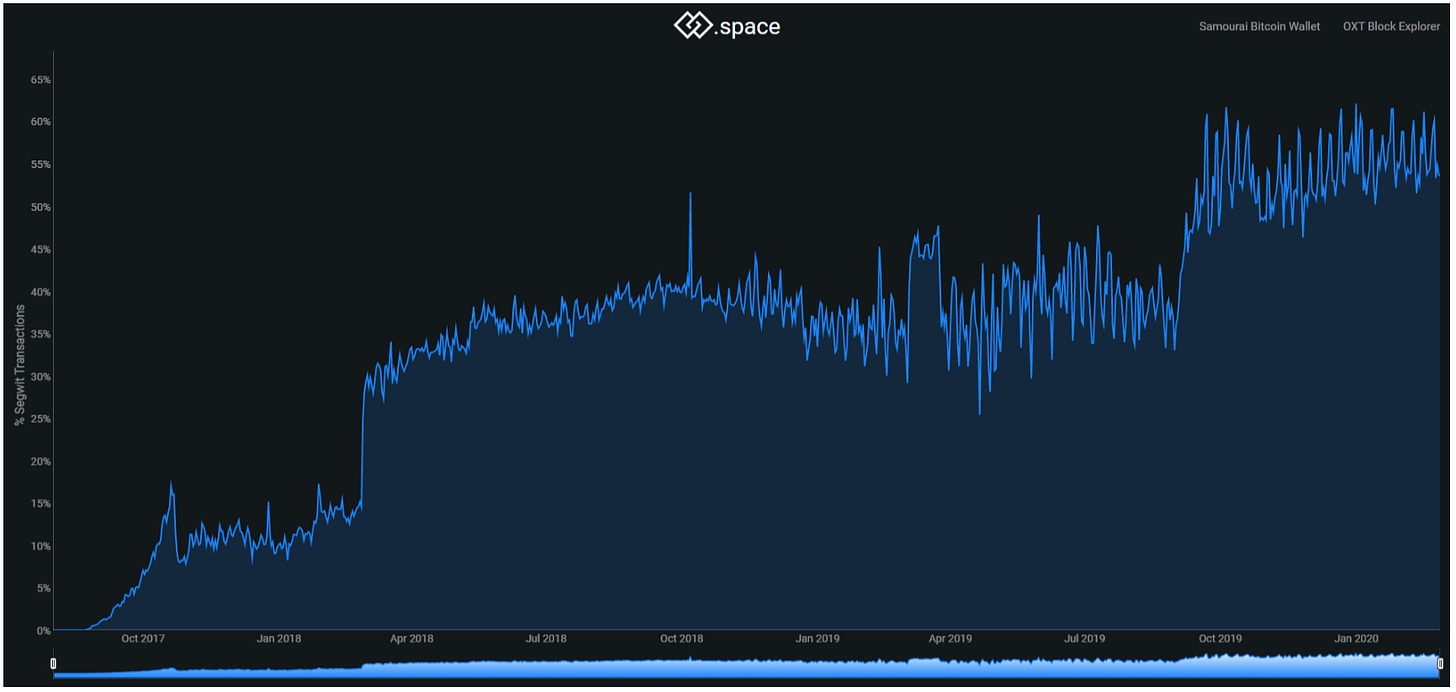

Why It Matters? - Pretty much everybody agrees that the greater the SegWit adoption rate, the better off the Bitcoin network will be. Yet, surprisingly, SegWit is only utilized by around 65% of bitcoin transactions today.

Therefore, the throughput of the bitcoin network is not fully optimized. This waste of available space results in higher transaction fees across the network. A main contributor to this snail-like adoption is the lack of sufficient incentives. Most of the transactions utilize an address format called P2SH, which is backwards compatible with clients that do not support the implementation. Backwards compatibility is the capability of a new version of the client to understand what was done by the older versions of a software. Bitcoin needs to be backward compatible forever, as the protocol has to understand transactions that were validated in the past. Using SegWit for transfers is both faster and economical than the standard protocol that the Bitcoin blockchain has. Exchanges like BitMEX and now Bitstamp are doing their part to remove unnecessary stress on the Bitcoin network. Straggler exchanges will continue to play an essential role in the implementation of this standard because mass transactions reduce the pressure on the Bitcoin network.

Final Take - SegWit adoption is a fundamental change that will allow further developments in Bitcoin.

Market Watch

- High: $9,978.12

- Low: $8,564.99

- ATTOW: $8,567.52

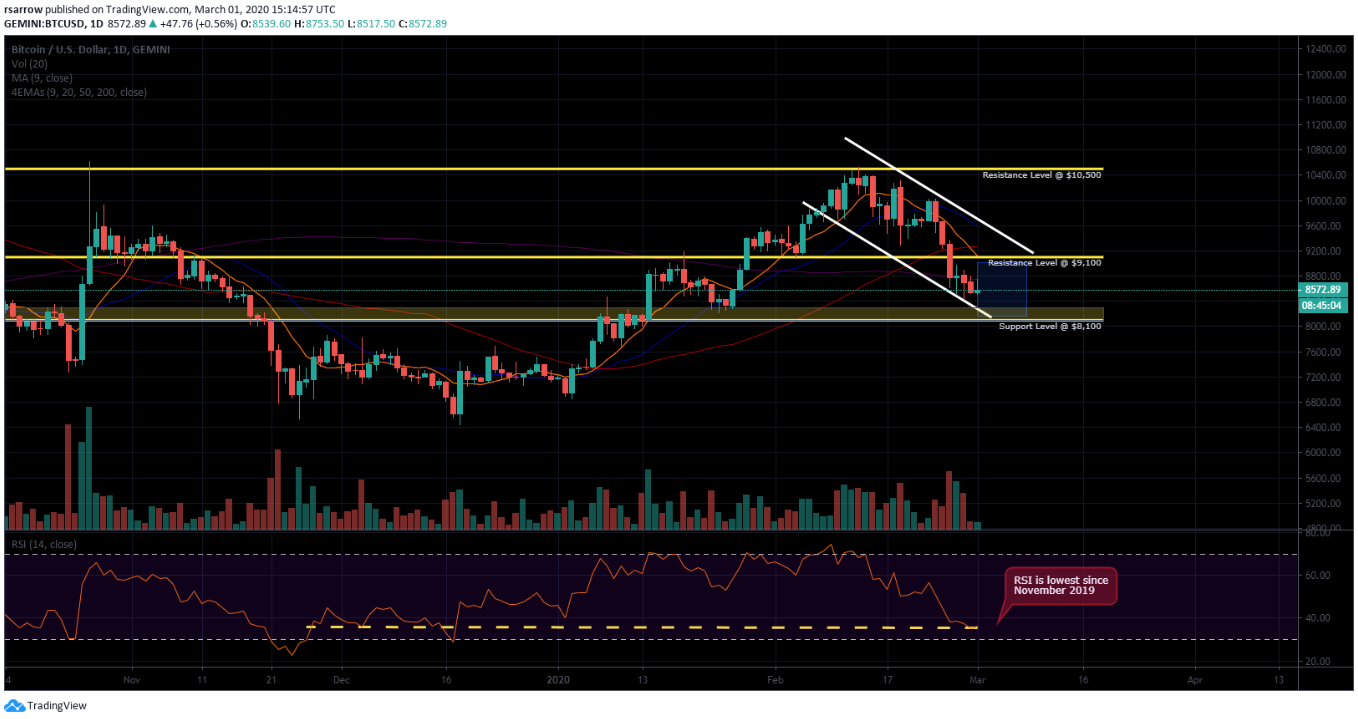

Just a week ago, Bitcoin was trading for more than $10,000 per coin. At the time of writing, the digital asset is trading around the $8,600 support level that it found after a $500 decline on Monday. Unfortunately bullish traders were unable to fight off sell pressure as Bitcoin saw over $1000 erased from its price in a three day period. Since February 13th, the price has entered a downward channel that has experienced multiple tweezer top candlestick patterns. This particular pattern is viewed as a bearish reversal pattern seen at the top of uptrends where two candles occur back to back with similar higher.

The daily RSI indicator is currently at its lowest value since the middle of November 2019, when Bitcoin was trading for $6,400. This weakness highlighted by the momentum indicator reflects on the recent price action. As the Bitcoin price dropped about 13% this week, it is not the lone asset seeing red. The effects of the coronavirus, or COVID-19, can be felt throughout the global economy with the Dow Jones Industrial Average falling over 1000 points on Thursday, the largest single day decline in its history. Though the bearish case would weaken with a close above $9,100, which would confirm seller exhaustion that can be attributed to Thursday's doji candlestick pattern. If this were to happen, $9,250 cannot be ruled out. The digital asset continues to chase after the 200-MA ($9,128) and volume has increased on the 2-hour chart. However, if the ongoing price decline continues, expect a slide to support levels near $8,100 and subsequently $7,500.

Announcements

- myNode v0.1.93 released - Link

- ZEBEDEE announces Developer Dashboard & Unity SDK - Link

- Casa launches Covenant Bitcoin Inheritance Solution - Link

- Coldcard Firmware v3.1.1. released - Link

- Square's CashApp reports $178M worth of bitcoin sold in Q4 - Link

- Swan Bitcoin Provides Simple Way to DCA into Bitcoin - Link

- Samourai Wallet v0.99.9 released - Link

Interesting Reads

- Bitcoin Optech #86 - Link

- Why FOSS Development Is Crucial For Bitcoin's Mainstream Acceptance - Link

Great Listens

- The Chaincode Postcast #1: Pieter Wuille pt. 1 - Link

- The Chaincode Postcast #2: Pieter Wuille pt. 2 - Link

- How to Run a Bitcoin Node - Link

- The Blockchain Debate Podcast #4: Bitcoin Halvening is Priced In - Link

- Off the Chain: Austin Rief - Link

- Bitcoin Around the World: Venezuela - Link

Final Quote

“Bitcoin however, is not a safe haven against declining profits,” he wrote. “It’s a safe haven against inflation, geopolitical strife, and central banks. So far, the stocks don’t seem to have realized any of these threats.”

Mati Greenspan, Founder of Quantum Economics, on why bitcoin was dropping at the same time stocks were plummeting.

Have a great week! See you next Sunday.

If you liked this post from The ₿it Economy by @rsarrow, why not share it? Use the link below to share on your social media platforms. Want to get in touch? Find time to connect here.