Week of 3.22.20 - Issue #20

Welcome to the 20th edition of the ₿it Economy! Each week, I break down the top stories in Bitcoin in a simple in clear format.

Topics: Difficulty Adjustments & Learning Campaign

The Brief:

The coronavirus outbreak has grinded the global economy to a halt. Governments currently have to manage a public health emergency at the same time as central banks act to calm financial markets. The United States, Europe, Japan, China and India are unleashing trillions of dollars in government spending and newly created money as they desperately attempt to keep the global economy from sinking into a depression. Don't believe me? Checkout this clip from 60 Minutes of Neel Kashkari, current head of the Federal Reserve Bank of Minneapolis.

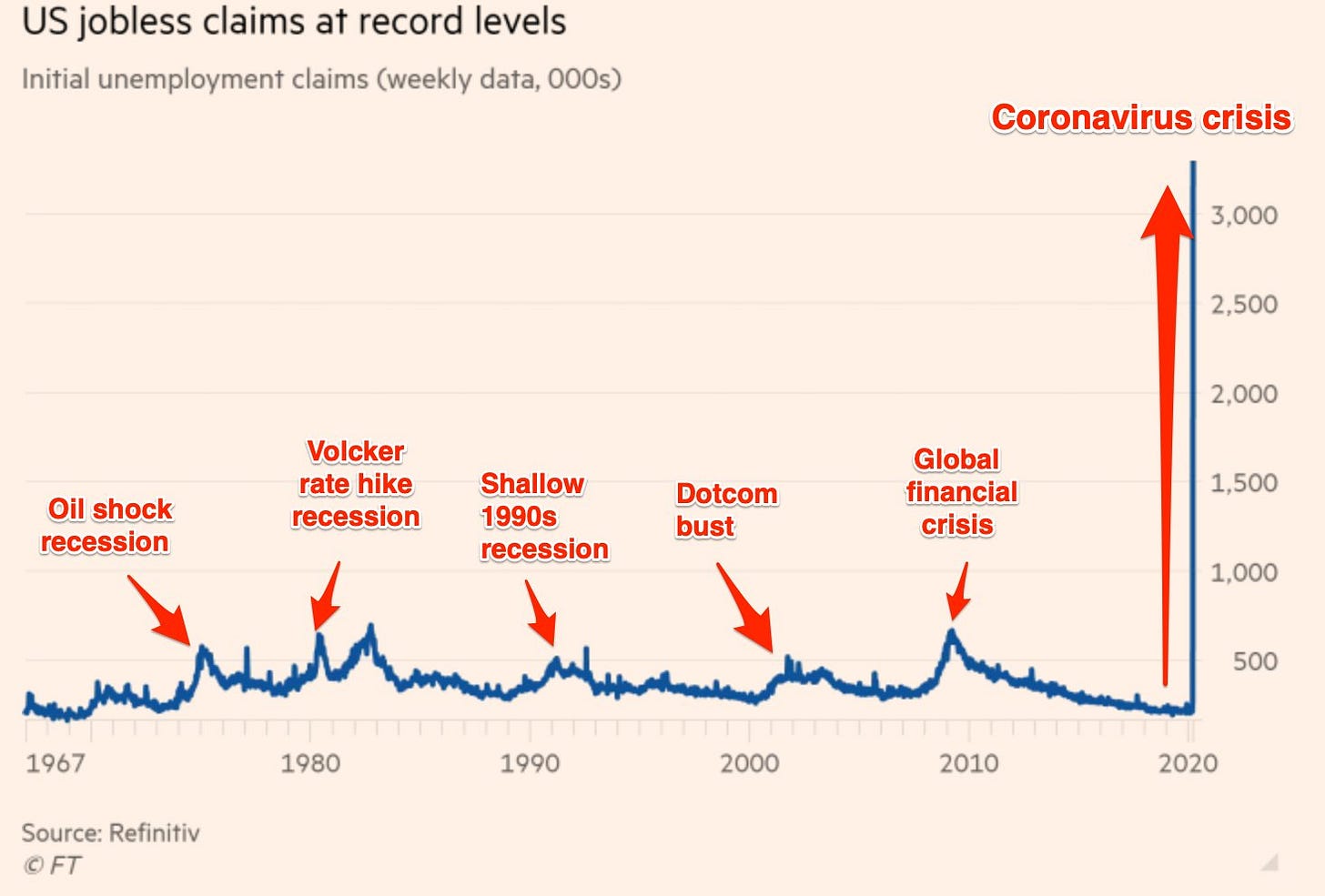

A scary thought right? To add injury to insult, the economic standstill has led to an abundance of unemployment filings. In a recession, millions of people become unemployed and as the chart below details, unemployment claims in the United States has jumped 4x higher than any week in history.

We are truly in unprecedented times. With that being said, this issue is jam packed with content. Over the past week, Bitcoin saw the second largest difficulty adjustment in it's history — going from 16.55 Trillion to 13.91 Trillion. Furthermore, as a better portion of the global population sits in quarantine, bitcoin-rewards company Lolli reminds you to not waste time. The firm announced its Learn & Earn campaign where it will be providing increased discounts to users who purchase online-courses on Udemy and Coursera. As for the interesting reads, checkout "This is Not Capitalism" from Allen Farrington. Albeit a long read, it condenses knowledge from several books and covers GDP, growth inequality, innovation and much more. And for those who prefer audio to text, checkout the What Grinds My Gears podcast which covers the recent Fed spending and the logistics behind the viral Money Printer Go BRR meme.

And finally, be conscious of those around you. We are going through tough times and this is only the beginning. Lend a hand where you can.

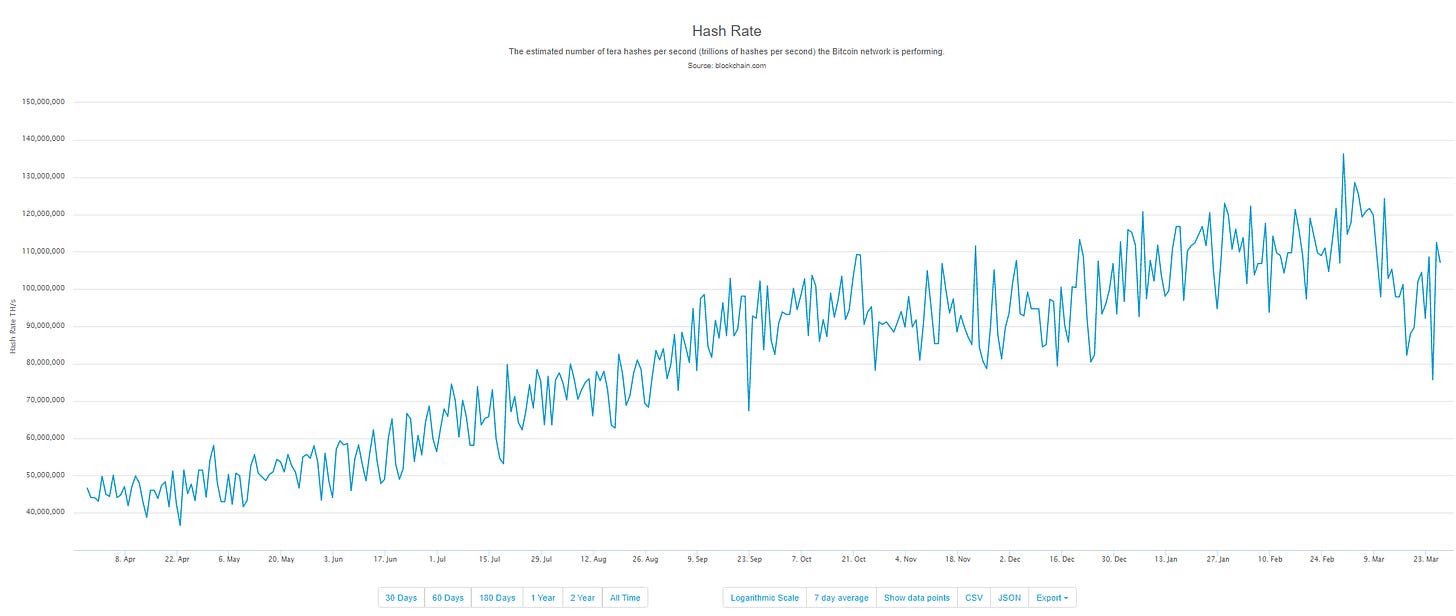

S1: Hash Rate Change

What is it? - The recent Bitcoin difficulty adjustment was the second largest decrease ever, going down by approximately 16%. Difficulty represents the number of hashes (solutions) necessary to find a solution below the given threshold. The difficulty adjusts every 2016 blocks, or about every two weeks based on the difficulty of mining the previous block set. Since the beginning of March, Bitcoin's hash rate has declined from 136 EH/s to 75 EH/s. The latest difficulty adjustment occurred on March 26 near 3:00 UTC where it dropped to 13.91 Trillion from 16.55 Trillion.

Why it Matters? - The notion of difficulty keeps Bitcoin in check. Difficulty is a number that regulates how long it takes miners to add new blocks of transactions to the blockchain. If mining were too easy, miners would overproduce. However, if it were too difficult, miners would eventually give up. Every time a mining rig shuts down, the Bitcoin protocol increases the incentive for other miners to stay online. Another way to think about it is if clothing were to close, all the remaining competition become more profitable.

To understand difficulty adjustment more deeply, here is a quick refresher on how mining works. In order to add a block of transaction to the Bitcoin ledger, a mining node has to find the solution to a random cryptographic problem. This solution or value is known as a nonce where it is continually incremented higher by miners until a block header with the corresponding hash value lower than or equal to the target is found. When a node successfully finds the solution, he or she is rewarded with 12.5 newly minted bitcoins, or approximately $80,000.

Randomness is key to the difficulty adjustment. Every 2016 blocks, the bitcoin protocol adjusts the difficulty by changing the range of possible random solutions that miners are trying to solve. In the case of decreasing difficulty, the protocol closes the range of possible solutions thus decreasing the time it takes miners to collectively guess the right answer. On the other hand, to increase difficulty, the range is enlarged.

The adjustment is determined by the amount of mining power on the network. The more mining power on the network results in more competition to solve blocks where difficulty is increased. The protocol's goal is to find a difficulty point at which the network solves a block and settles outstanding transactions every 10 minutes. As for miners, the decrease in difficulty lowers the amount of time, processing power and electricity needed to solve a block.

If there were no difficulty adjustment to make it harder to mine blocks at an increased hash power, then the rate of bitcoin issued would grow at a faster pace than the predetermined ten minutes. As a result, the Bitcoin network could be exposed to a rising stock-to-flow ratio that has caused issues with fiat currencies and precious metals.

In a case where a large number of miners are forced to go offline, the decline in difficulty increases the relative reward for miners who can remain operational. Therefore the cost to mine a block decreases as the miner's ability to make a profit increases. We see this play out in real time as the drop offers a boost to the remaining Bitcoin miners, who now need less computing power to achieve the same probability of mining a coin. Miners that can operate at a loss have the advantage of mining bitcoin with a higher probability when other miners leave the market.

As Satoshi Nakamoto described in the Bitcoin whitepaper:

“To compensate for increasing hardware speed and varying interest in running nodes over time, the proof-of-work difficulty is determined by a moving average targeting an average number of blocks per hour. If they’re generated too fast, the difficulty increases.”

This description is vital for understanding the consistent issuance of bitcoins at 10 minutes - along with its economic impact - and the incentive design within the mining ecosystem. No matter how much hash power the Bitcoin network aggregates, the problem of "overmining" for an extended period of time is not a worry due to the difficulty target adjustment.

Final Thought - Bitcoin's difficulty adjustment is an often overlooked component of the protocol that continues to have an enormous impact on the digital asset's viability.

S2: Lolli's Earn & Learn Initiative

What is it? - Lolli, the Bitcoin cashback provider announced a new campaign on Tuesday where users can earn bitcoin when they learn about bitcoin. Users can now earn 16% and 18% respectively bitcoin back on thousands of online courses at Udemy and Coursera. Udemy currently offers over 2,000 courses related to Bitcoin and blockchain while Coursera has 43 Bitcoin focused programs.

As a refresher, Lolli is a web plug-in that gives online shoppers cash-back rewards int he form of bitcoin. Shopper still make their purchases in fiat via a credit card, but the cash back comes in bitcoin deposited to the user's Lolli wallet.

Why it Matters? - With COVID-19 sending everyone inside, many may be wondering what to do with all the extra time at home. Rather than get lost in the sea of worrisome news and social media posts, turn your attention to developing your skillset or learning something new. It is easier than ever to further your education and career skills and Lolli is providing you with Bitcoin to do so. The world is rapidly changing and new skills are needed constantly. There are lots of way to teach yourself with blogs, apps, and online courses. Below are a few courses that are worth a look:

Bitcoin and Cryptocurrency Technologies - Princeton University

After this course, you’ll know everything you need to be able to separate fact from fiction when reading claims about Bitcoin and other cryptocurrencies. You’ll have the conceptual foundations you need to engineer secure software that interacts with the Bitcoin network. And you’ll be able to integrate ideas from Bitcoin in your own projects.

ECO21: The Bitcoin Standard - The Decentralized Alternative to Central Banking

While Bitcoin is a new invention of the digital age, the problem it purports to solve is as old as human society itself: transferring value across time and space. This course embarks on an engaging journey through the history of technologies performing the functions of money, from primitive systems of trading limestones and seashells, to metals, coins, the gold standard, and modern government debt. Exploring what gave these technologies their monetary role, and how most lost it, provides the reader with a good idea of what makes for sound money, and sets the stage for an economic discussion of its consequences for individual and societal future-orientation, capital accumulation, trade, peace, culture, and art. Compellingly, Ammous shows that it is no coincidence that the loftiest achievements of humanity have come in societies enjoying the benefits of sound monetary regimes, nor is it coincidental that monetary collapse has usually accompanied civilization collapse.

Bitcoin: The Money of the Future - Everything You Need to Know

But what is Bitcoin? Why is it here? What is it's purpose? How do you use it? Where is it going? Is it a good investment? Will it catch on? This course will answer all of these questions and more! Friends, Bitcoin is changing the world... forever. There will be no going back. Now is the time to learn everything you need to know to get involved while Bitcoin is still in its infancy.

And for those who do not wish to spend during these tough times checkout Jameson Lopp’s Bitcoin Information & Resources page.

Final Take - Spend this extra time at home focusing on more productive things than Netflix and scratch that curiosity itch.

Market Watch

- Total Market Capitalization: $171.49 billion

- Bitcoin Market Cap: $114.56 billion

- BTC Dominance: 66.56%

- High: $6,770.13

- Low: $5,817.83

- ATTOW: $6,140.85

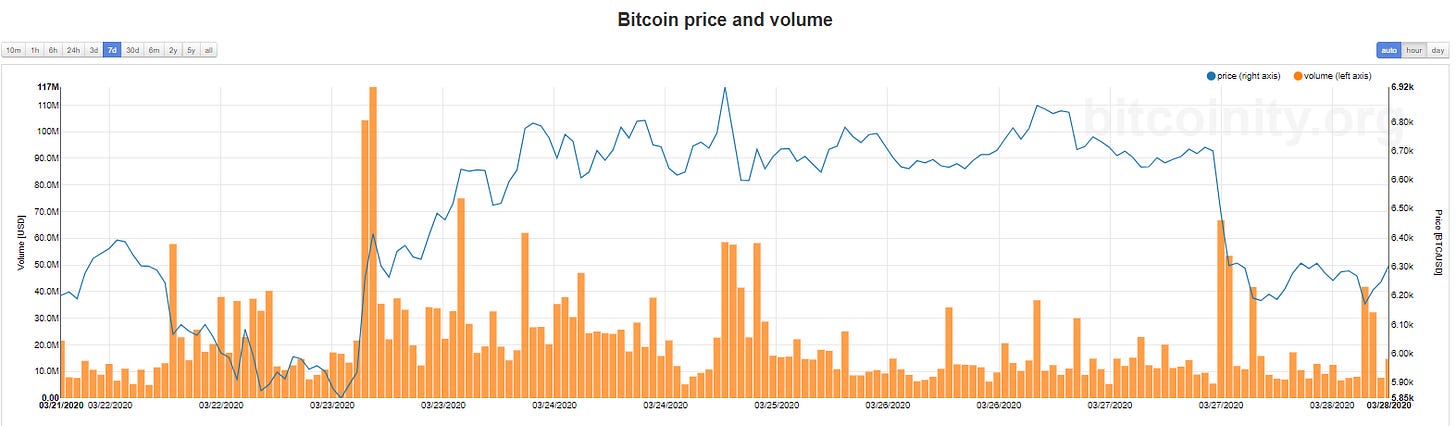

Bitcoin looks poised to finish the week in the green despite a recent downtrend over the latter half of the week. The digital asset has recovered from sub $6,000 levels and came close to eclipsing psychological barrier $7,000 on March 25th. Earlier in the week we saw Bitcoin bounce from the Fed announcement of "unlimited asset purchases", trading up almost 10% of its lows of the day.

This positive sentiment pushed well into Wednesday as the United States announced a two-trillion dollar stimulus package. However, soon after the announcement investor sentiment shifted to a more bearish outlook as the $6,900 was rejected. This can be seen on the daily chart as Wednesdays candle has a long upperwick attached to it. Furthermore, the pullback erased most gains on the week. As of Saturday, the price continued to decline and is currently trading between the $6,000 and $6,300 range.

At the time of writing, bitcoin remains in an ascending channel as seen on the 4-hour chart. A break below the lower end of the channel would imply a drop to the support levels near $5,800.

Furthermore, daily volume has continued to trend downward from recent highs on March 13th.

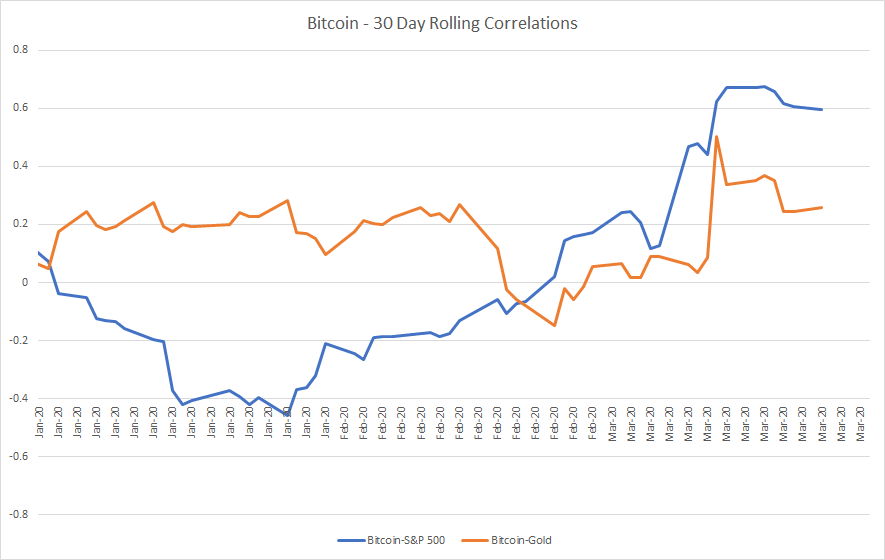

The correlation between bitcoin and the S&P 500 Index has entered into a positive range over the last couple of weeks. While correlations between Bitcoin and other financial assets are generally neither substantial nor enduring, the rolling 30-day chart below suggests that they have been intertwined as of late.

Moreover, the digital asset is often compared to gold in risk-off scenarios. Gold is one of the few markets around the world that remains relatively stable following mass selloffs just about everywhere. Gold behaves in such a way, due to the asset's limited supply. Bitcoin's supply is capped at 21 million BTC and its movement since March 12th decrease has further solidified this possibility. The price movement shows a considerable correlation as both assets have moved in the same direction, albeit at different magnitudes.

Bitcoin's price has not always traveled in line with traditional markets. On average, Bitcoin's price does not follow traditional markets during times of decreased price swings. The heightened correlation between Bitcoin and the equity market suggests that institutional investors experienced a flight-to-cash where all assets perceived as too risky were sold off in the last two weeks.

Historically, legacy markets need to stabilize in order for buyers to return to the digital asset market. Though the short-term outlook indicates bearish sentiment, expect Bitcoin to recover as the real impact of quantitative easing and central bank money printing comes to fruition.

Announcements

- Breez Wallet Adds PoS to Mobile App - Link

- Graphene OS v2020.03.23.22 Released - Link

- Tor Browser v9.0.7 released - Link

- Coinkite Coldpower Adapter Released - Link

- Tails OS v4.4.1 Released - Link

- Nodl Dojo v.0.0.8 Released - Link

- JoinMarket v0.6.2 Released - Link

Interesting Reads

- Bitcoin Optech #90 - Link

- This is Not Capitalism - Link

- Privacy & Cryptocurrency: Bisq, RuneScape and Stories from Buying Bitcoin Anonymously - Link

- Latin American Bitcoin Trading Follows the Heartbeat of Venezuela - Link

- CDC Coronavirus Surveillance and Data Collection - Link

- Corporate Socialism: The Government Bailing Out Investors & Not You - Link

- Zero Interest, Limitless Repo and QE4 - Link

- How the Economic Machine Works: Leveraging & Deleveraging - Link

- Overton Window Opens for a Digital Dollar - Link

- Bitcoin 101 - Link

Great Listens

- TFTC Guides: Graphene OS + Pixel 3a Install Guide

- Stephan Livera Podcast #160 : BTCxZelko - Link

- Pomp Podcast #249: Preston Pysh - Link

- Tales from the Crypt #144: Michael Krieger - Link

- What Grinds My Gears #29: Money Printer Go BRRR - Link

- What Bitcoin Did: Raoul Pal on the Social & Economic Impact of Coronavirus

- Invest Like the Best: Dan Rasmussen - Link

- Hidden Forces #127: Ben Hubbard - Link

Final Quote

Have a great week! See you next Sunday.

If you liked this post from The ₿it Economy by @rsarrow, why not share it? Use the link below to share on your social media platforms. Want to get in touch? Find time to connect here.