Week of 4.12.20 - Issue #23

Welcome to the 23rd edition of the ₿it Economy! Each week, I break down the top stories in Bitcoin in a simple in clear format. Enjoy!

Topics: Vaults, Privacy & Inflows

The Brief:

As countries around the world race to contain the pandemic, many are developing digital surveillance tools as a means to exert social control. Health and law enforcement authorities are understandably eager to employ every tool at their disposal to try to halt the virus - even as the surveillance efforts threaten to blur the line between public safety and personal privacy. Concerns about what Google and Facebook might be doing with patients' sensitive health information have gone quiet, and citizens around the globe are being asked to permit surveillance of their daily movements and contacts.

Lost in the largest relief bill in United States history, Congress allocated $500 millions for a "public health surveillance and data collection system" intended to track the spread of the virus. After being caught flat-footed by the public health crisis, policymakers have sought to repeal privacy rights that draws and eerie comparison to that of the terrorist attacks of 9/11. At that point in time, the government quickly responded by attempting to expand executive power via the Patriot Act. This bill, built the foundation for what is probably the world's most expansive surveillance state and created the Department of Homeland Security.

Though a proposed national network could help determine which areas of the country could safely relax social distancing rules it would also represent an unparalleled expansion of the governments use of individual patients data. The prospect of compiling a national database of potentially sensitive information has promoted concerns about its impact on civil liberties well after the threat of the coronavirus recedes. The proposed system would allow the federal government and the private sector to continuously track citizens every move. Don't believe me? We'll checkout this video from analytics firm Tectonix.

The results of tracking "anonymized" data showed where people went after they visited the beach, spreading out all across the country. The data comes from Big Tech mobile location data and is intended to identify trends, large-scale behavior and most importantly, ensure people are practicing social distance. Anonymized data lies at the core of everything from modern medical research to personalized recommendations and modern AI techniques. It is supposed to have all personally identifiable information removed from it, while retaining a core of useful information for researchers to analyze without the fear of invading privacy. Unfortunately, data can easily be deanonymized in a number of ways. Checkout this paper from the Imperial College London and Belgium’s Université Catholique de Louvain where researchers have correctly re-identified 99.98% of individuals anonymized data.

“Our results suggest that even heavily sampled anonymized datasets are unlikely to satisfy the modern standards for anonymization set forth by GDPR [Europe’s General Data Protection Regulation] and seriously challenge the technical and legal adequacy of the de-identification release-and-forget model,”

The impulse to turn to high tech tools in this time of crisis is understandable — there are lives at stake. However, history offers ample reason to proceed with caution for one an inch is given a mile is taken. Many years after the passing of the Patriot Act, government analysis found that mass data collection for counterterrorism purposes was ineffective. The mass surveillance turned out to be unproductive and even counterproductive since it ended up burying useful intelligence.

And for those who do not are not weary of the government's use of location data, may i direct your attention to the recent increase of drone usage.

It is imperative to weight the potential value of using location data against the impact of civil liberties. Historical records of a person's cell site location data over an extended period of time can uncover highly sensitive information such as their home, activities, associations and beliefs. We are walking, talking data factories that send texts, Snapchat friends and watch Netflix. We generate an obscene amount of data on a minute-by-minute basis.

The fast pace of the pandemic is prompting governments to 'move fast and break things' by designing patchwork digital surveillance measures in the name of their own interests, with little to no coordination on how appropriate or effective they are. To learn more about which countries are monitoring what please refer to this post from Dave Gershgorn.

So where does that leave us? Will we go back to normal or will the erosion of privacy become part of the fabric of daily life, accepted as the price of continued vigilance against new viruses, in the same way Americans tolerated the loss of privacy and personal freedoms after the 9/11 terrorist attacks?

In other news, this was a jampacked week of news and content for Bitcoin. Core developer Bryan Bishop recently released a prototype for bitcoin vaults. Storing private keys can be challenging and the proposal aims to lend a hand to large-scale custodians by offering a solution to lock up coins in such a way that a theft could be temporarily reversed. BTCPay Server, the self-hosted, open-source digital asset payment processor announced that it supports PayJoin, a privacy implementation which breaks a key assumption used by surveillance protocols. And finally, numerous Bitcoin-on ramps announced that both retail and institutional interest in Bitcoin has increased since the beginning of the COVID-19 crisis.

I want to highlight a couple must reads in the Interesting Reads section of this weeks newsletter. First off, checkout why our economic policies have failed us in This is Water from Ben Hunt’s Epsilon Theory. Second, a piece from Nic Carter titled “Bailouts Don’t Save the Economy. They Prop Up Companies That Should Be Allowed to Fail”. Both of these paint an intriguing picture on how we ended up in this current financial situation. Third, if you are longing for more Bitcoin content, take a look at Dan Held’s first edition of his four part series Planting Bitcoin — Species.” And finally, legendary venture capitalist and entrepreneur Marc Andreessen broke Tech Twitter Saturday night with the release of his rally cry piece titled IT’S TIME TO BUILD.

S1: Bitcoin Vault Proposal

What is it? - On this past Monday, Brian Bishop, unveiled a fork-free prototype of a Bitcoin Vault. As of August of last year, Bishop, a Bitcoin Core developer and recently announced CEO of Avanti Bank, mentioned that he had revamped the original 2016 concept for what is ostensibly a way to delay Bitcoin transactions before actually sending them.

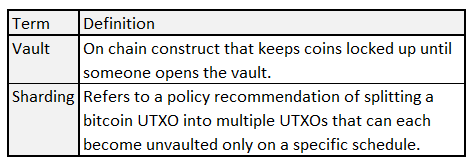

Before diving in further lets define a couple of terms:

The original idea was based on the concept of special Bitcoin addresses that had two private keys: a "vault" and a "recovery". In this case the "vault key" is utilized to spend coins whereas the "recovery key" is utilized to reverse the transaction to a specific point in time. One of the drawbacks with this proposal is with the case where an attacker obtains both keys. Though the attacker has the keys, he or she would not be able to unlock the vault, thus rendering the keys useless. Unfortauntely, like the attacker, the vault creator would also not be able to access the funds.

Last year, Bishop proposed the use of three transactions for iterating through the various conditions of the vault process that would enable the vault concept to materialize without the need for a hard fork. The transactions are as follows:

1. Vault Transaction

Will lock up coins in such a way that it can be unlocked only with a specific private key. This specific private key is utilized to create and sign the second transaction, or Delayed-Spend Transaction.

2. Delayed-Spend Transaction

This transaction can be spent in two ways:

By the owner, who intends to spend the bitcoins post the pre-set time interval.

Spend the coins immediately, which requires a different private key. The other private key is used to create and sign the third transaction, or Re-Vaulting Transaction.

3. Re-Vaulting Transaction

Sends the bitcoin to a backup address or to a new vault.

This process is non-reversible therefore each transaction step can only be unlocked by the next phase. So the original vault transaction is broadcasted to the Bitcoin network as an on-chain transaction where the owner of the vault now has bitcoins linked to his or her vault address. This owner can now spend the bitcoins by broadcasting the delayed spend transaction and waiting for the allotted period.

The proposed clawback mechanism is in place to protect one’s assets if their security falters. To utilize this feature, a user relies on a watchtower to essentially slow down the pace at which an attacker could acquire their bitcoin. The user would receive a notification if BTC were to move from a shard.

This project provides a prototype for bitcoin vaults based around the concept of sharding and pre-signed transactions. The advantage of sharding into many UTXOs with different relative timelocks is that it gives the user an opportunity to observe on-chain thefts and react to them, without losing 100% of the funds.

Why it Matters? - The proposal comes at a time where exchange hacks, both centralized and decentralized, continue to plague the digital asset space (See: SelfKey List). Investors have come to rely on exchanges due to their ability to provide liquidity and most importantly, their convenience. Oftentimes, peer-to-peer (P2P) exchanges like Bisq or Paxful are overlooked when compared to their centralized counterparts.

Though the security of large exchanges has evolved to the point that there are few points of failure — they still exist. Security problems are an endemic but with vault transactions, exchanges have the ability to review all spent transactions within a specific time delay period. This effectively mitigates the ability of hackers to get away with the stolen funds in a short matter of time. As a friendly reminder, you should always keep your funds off exchanges to avoid any malicious behavior. Not your keys, not your coins.

Final Take - Though not ready for production, Bryan offers a creative way to protect user funds that does not require a hard fork of the network.

S2: BTCPay Server Supports Privacy

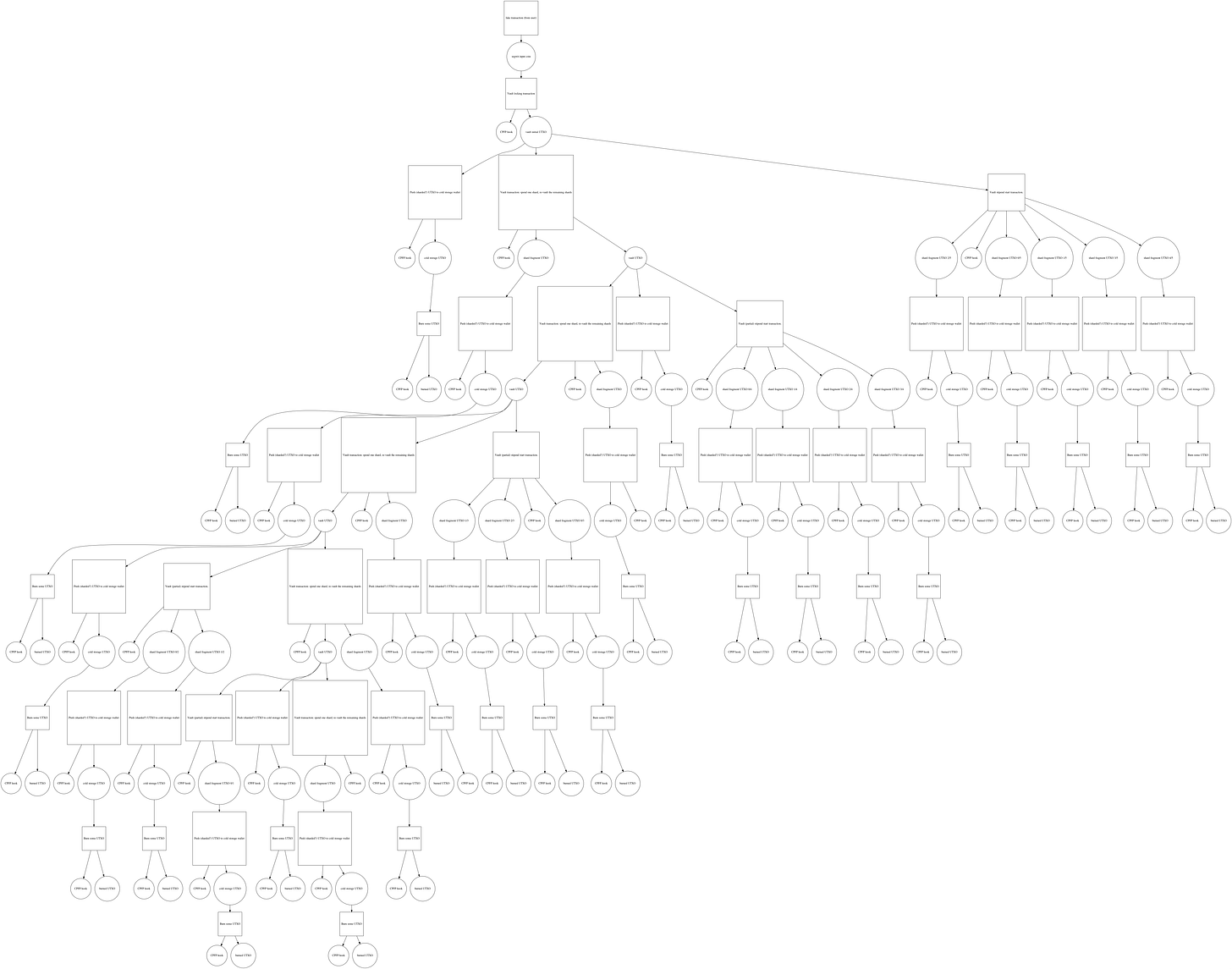

What is it? - Bitcoin payment processor BTCPay Server, an open-source platform has added support for Pay to Endpoint (P2EP), commonly referred to as PayJoin. PayJoin is a special type of CoinJoin, a method for combining multiple bitcoin payments into a single transaction in order to further one's privacy (Refer to issues #5 & #13 for a CoinJoin refresh). In a blog post, Blockstream, the blockchain technology firm who funded the development of P2EP describes the implementation as follows:

"P2EP transactions are special in that both the sender and the receiver of the payment coordinate to build the bitcoin transaction," says the company. "Unlike a regular bitcoin transaction, where only the sender spends from their wallet, a P2EP transaction packages up inputs from both the sender and the receiver, with the receiver sending extra bitcoins to themselves."

The central concept behind P2EP is simple yet effective: the receiving party in a payment takes part in the CoinJoin. If Alice pays Bob, Bob participates in Alice’s CoinJoin transaction to him, so he also pays himself. Therefore the the protocol further obfuscates the ownership of UTXO inputs during a Coinjoin transaction mixing cycle.

Amid the announcement, the Human Rights Foundation (HRF) let the world know that it now accepts Bitcoin donations through PayJoin. The HRF is a non-profit organization whose mission is to ensure that freedom is both preserved and promoted around the world.

Why it Matters? - Unless you have been living under a rock for the past twenty years, it's pretty obvious that the world (led by Sweden, China,South Korea and more) is trending towards a cashless society. The rise of digital payment providers like Paypal and Venmo have brought a sense of effortlessness in the way we transact. Convenience has always been king but have you ever sat down and thought about the sensitive data these firms collect? In the absence of financial privacy, individual freedoms (like yours and mine) can be denied as every purchase we make can be traced, surveilled and censored.

This is no different with digital assets like Bitcoin as it works with an unprecedented level of transparency. All Bitcoin transactions are public, traceable and permanently stored in the Bitcoin network. This makes it susceptible to pattern matching from blockchain analysis firms who, over the past few years, have kicked into high gear as law enforcement and government have begun heavily funding them.

A CoinJoin allows multiple users to mix their bitcoin transactions together, making it less obvious to these firms who owns which bitcoin. However, these analysis firms are getting better at identifying trends thus exposing user privacy. On the other hand, after a PayJoin transaction is completed, the transactions look identical to other transactions on the blockchain.

Privacy implementations allow users to transact freely without having the worry of who or what organization is tracking their financial movements. Cash remains one of the best ways to exercise free speech therefore it is key is to find digital mediums of exchange that preserve its distinct attributes: permissionless, peer to peer and untraceable. Why you ask?

“Study after study has shown that human behavior changes when we know we’re being watched. Under observation, we act less free, which means we effectively are less free.” — Edward Snowden (Q&A with RT)

Large sums of digital cash can be subject to the same scrutiny and reporting requirements as physical cash. That is why we have a way out with Bitcoin. Most bitcoin users understand that privacy is an important feature, but few appreciate how important it is from the perspective of upholding the core properties of Bitcoin.

Final Take - Bitcoin was created, among other reasons, to protect ones individual freedoms.

S3: Bitcoin Inflows

What is it? - After weeks of waiting, millions of tax-paying Americans received their $1,200 stimulus check this week. Coincidentally, on Thursday, Brian Armstrong, CEO of the digital asset exchange Coinbase, shared an image that shows the exchange saw a record spike in deposits of $1,200. The company processed exponentially more $1,200 purchases of cryptocurrency than it does on a regular basis, with the percentage of buys (or deposits) of that amount growing from approximately 0.08% to 0.375% the day prior.

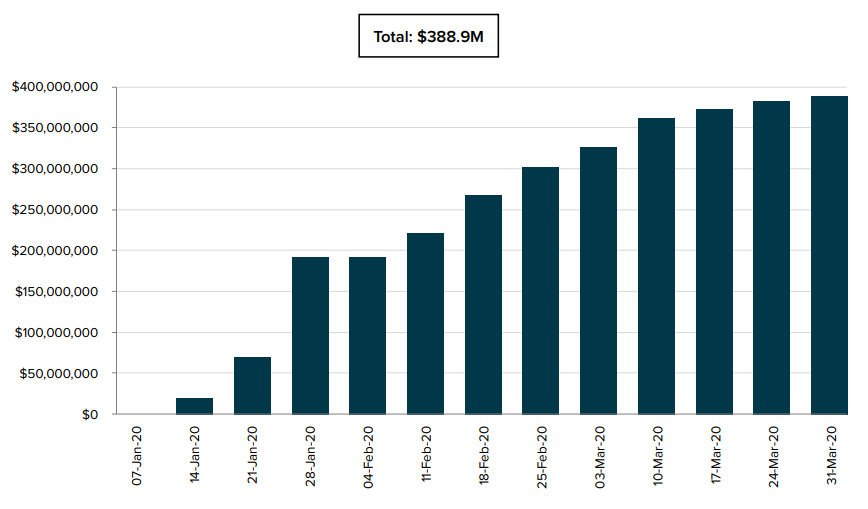

In the first quarter of 2020, Grayscale experienced its largest influx of inflows in the firm's history, raising $388.9 million, nearly double the previous high of $245.8 million in the third quarter of 2019. Grayscale's steady increase in investments during a time where there's been a flight to cash and a large sell-off of "high risk" assets makes the data even more fascinating. As shown in the chart below, Grayscale's inflows have increased each week since the COVID-19 virus has disrupted the economy.

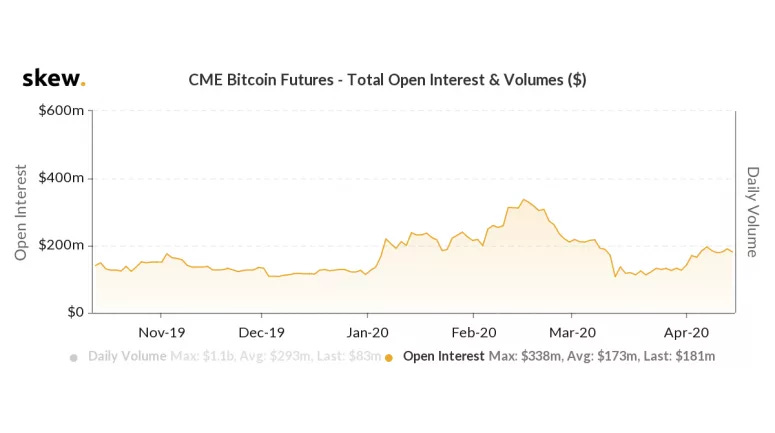

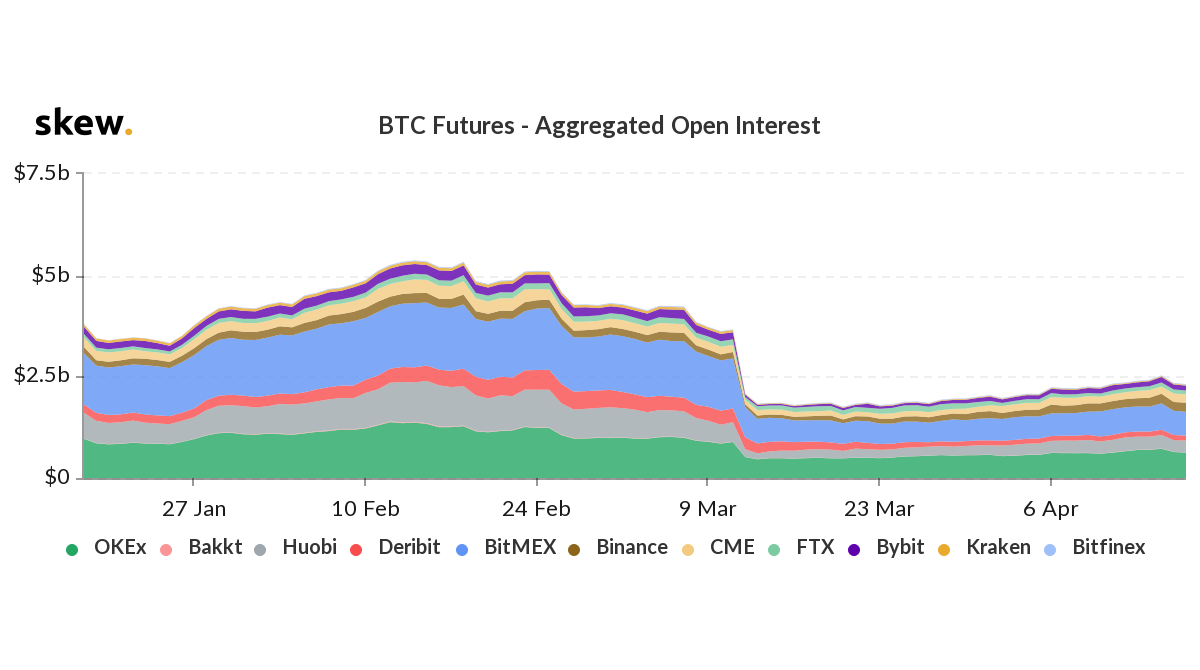

The Chicago Mercantile Exchange or CME, also reported an influx of institutional investment in Bitcoin futures this week. The open interest jumped 70% to $181 million from $106 million in March. CME's derivatives data, aggregated by Skew, highlights the uptick in interest.

Square's Cash App received regulatory approval to allow citizens who don't usually file a tax return to direct forthcoming government stimulus payments to the mobile application.

Square and it's peer-to-peer (P2P) payments product has been very supportive of Bitcoin since 2018 so there is no surprise that users can receive their stimulus checks and quickly purchase bitcoin with it. Late last month, the firms CFO, Amrita Ahuja said during an investor call that it has seen an uptick in bitcoin engagement amid the market turmoil driven by the coronavirus.

"Adoption and engagement of fractional equity investing in Bitcoin has accelerated in recent weeks given recent market interest and volatility," CFO Amrita Ahuja said on the call."

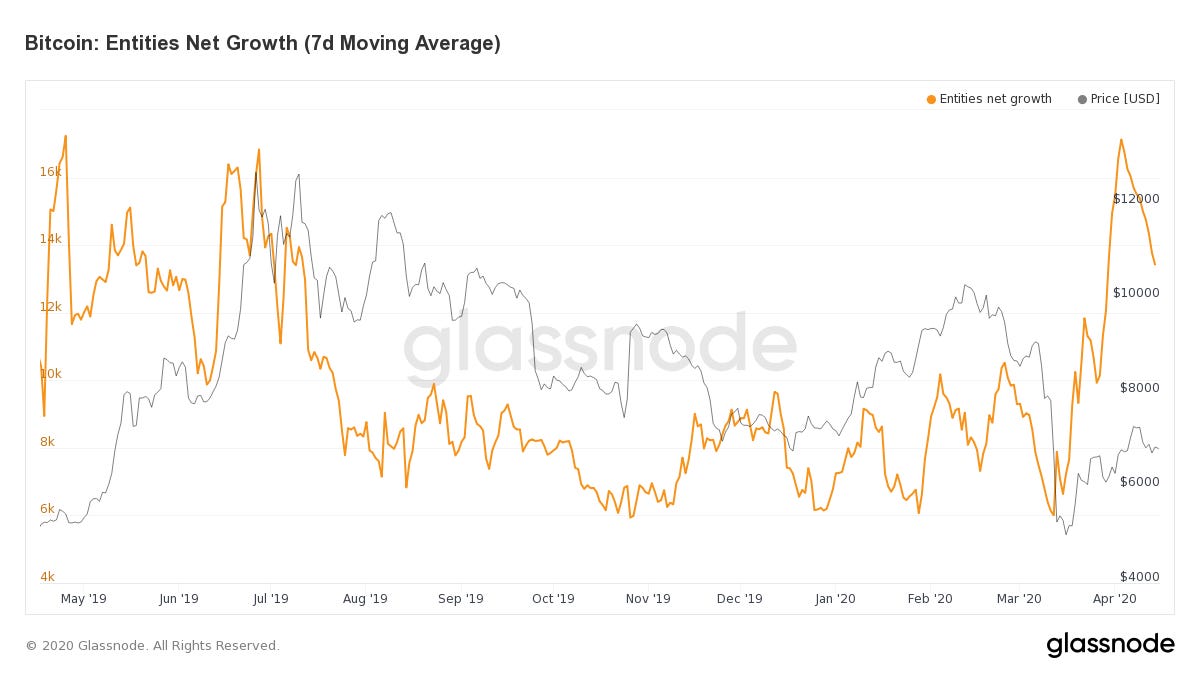

Why it Matters? - As global markets are plagued with ever more uncertainty and doubt, retail and institutional interest in bitcoin is increasing. The $2.2 trillion coronavirus stimulus package signed by President Trump in March was intended to ease the financial pain prompted by closing the economy to fight COVID-19. Eligible citizens have spent much of this money on food, rent, mortgage payments and other essentials. As shown in this chart from Glassnode, new user activity on the Bitcoin network has accelerated from 6,000 to 17,000 new entities per day.

The traditional financial outlook looks grim when considering record unemployment claims, reports of an additional stimulus package and arguably no sign of a vaccine in sight. Regulators have backed themselves into a corner as interest rates plummet, thus prompting investors to search for a safe place to store their wealth.

Predictably enough, the majority of check recipients spent the money on essentials, including food, money transfers, gas, grocery items, and bill payments. However, a sizable chunk of recipients spent a part – or in some cases – all of $1,200 on bitcoin. Does this make Bitcoin essential? The jury is still out on that but as a non-sovereign, hardcapped supply, global, immutable, decentralized store of value, a further influx is likely. With further quantitative easing likely, the potential of a rise in inflation and institutional interest continuing to grow, individuals will be searching for safe-haven assets. As a hedge and alternative to fiat, many have chosen to trod down the Bitcoin rabbit hole trusting the security and fungibility of the digital currency.

Final Thought - Bitcoin's fundamentals are poised to thrive under the coronavirus crisis, only a matter of time.

Market Watch

- Total Market Capitalization: 204.32 billion

- Bitcoin Market Cap: 131.28 billion

- BTC Dominance: 64.29%

- High: $7,258.25

- Low: $6,626.69

- ATTOW: $7,162.19

This week, Bitcoin remains in the $6,500 - $7,500 channel. The digital asset has retraced over 80% of the crash that occurred on March 12th. After testing the upper border of the channel last Sunday, the digital asset headed to the lower bound of $6,500. Bitcoin continues to form a rising wedge pattern with falling volumes. Before the full economic impact of the coronavirus had been felt, Bitcoin was showing signs of a local top located near $10,500. The price rejected at the critical multi-year resistance level and dropped in the days that followed.

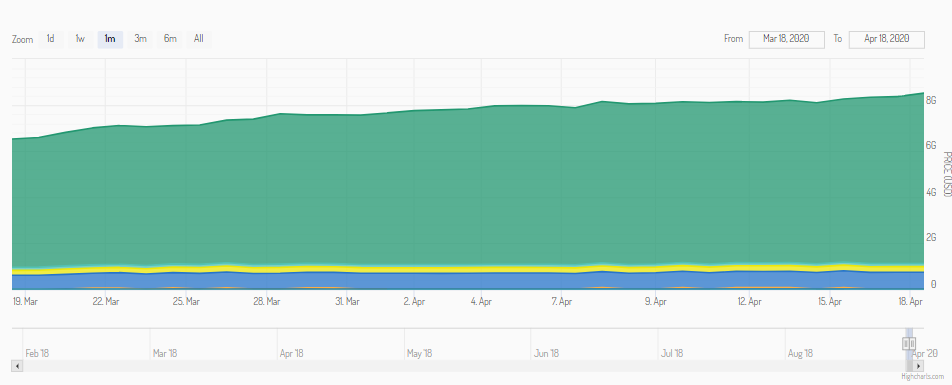

Though this time could be different, it is difficult to look past the similarities between the two periods. Over the past two weeks, the supply of Tether (USDT), a fiat collateralized stablecoin, has increased considerably by over $2 billion; surpassing $6.3 billion in market capitalization. In times of crisis and economic uncertainty, it's common to see demand for haven investments increase. In the Bitcoin ecosystem, that role is filled by stablecoins. The recent outflow of funds from digital assets to the like of Tether indicates that investors are seeking safety from violent volatility. The growing value of these tokens sidelined on exchanges suggest that investors are not leaving the market completely but rather waiting for the right moment to reenter. There is a lot of "dry powder" that could spark a price increase.

When bitcoin trades within a tight range, as it has over the past few weeks, investors often turn to open interest in order to asses the volatility appetite in the market. Open interest refers to the value of outstanding futures contracts that have not been settled yet. An increase in open interest signals that more money is flowing into the market and that traders are anticipating a near term rise in the underlying volatility.

Prior to the crash one month ago, the open interest of bitcoin on popular derivatives exchanges was over $3.5 billion. As of today, open interest sit near $2 billion., suggesting that the price of bitcoin may still see further consolidation in the near-term.

So what does this mean for this week? A break and close above key resistance at $7,500 would welcome $8,000 into the picture. On the other hand, if the price continues to play out the rising wedge with low volumes, one cannot rule out a retracement to sub $7,000 levels. Because the global economy has never been frozen in the way it is now, there is no telling as to what the traditional market actions impact will have on the price Bitcoin.

Announcements

-Trezor One & Model T Firmware Update 1.9.0 & 2.3.0 - Link

-Zap Android Client Adds Multi-Wallet Support - Link

-Purse.io Shuts Down - Link

-Binance Launches Mobile Options Trading - Link

-Samourai Whirlpool CLI v0.10.5 Released - Link

-Samourai Wallet v0.99.93 Released - Link

-Breez Wallet Adds Keysend Support - Link

Interesting Reads

- Bitcoin Optech Newsletter #93 - Link

- Planting Bitcoin — Species - Link

- 21 Million is Non-Negotiable - Link

- This Is Water - Link

- The State of L2 Investments - Link

- Avoiding the Digital Panopticon - Link

- ELI5: Utreexo — A Scaling Solution - Link

- Central Banks Recommended To Ban Stablecoins - Link

- Utilizing Public Blockchains for the Sybil Resistant Boostrapping of Distributed Anonymity Services - Link

- The Price of Discipline - Link

- Bailouts Don't Save the Economy - Link

- IT’S TIME TO BUILD - Link

Great Listens

- When Bad Policy = Bad Business Models = Bad Public Health - Link

- Citizen Bitcoin: Matt Odell - Link

- Hidden Forces #133: Surveying the Damage - Link

- Pomp Podcast #268: Jeff Booth - Link

- Tales From The Crypt #149: Steve Barbour - Link

- What Bitcoin Did Podcast #213: WTF Happened in 1971 - Link

- Venture Stories: Ali Hamed & Brent Beshore - Link

- The Investor's Podcast Network #292: Leland Miller - Link

Final Quote

Have a great week! See you next Sunday.

If you liked this post from The ₿it Economy by @rsarrow, why not share it? Use the link below to share on your social media platforms. Want to get in touch? Find time to connect here.